san francisco sales tax rate 2018

San Jacinto CA Sales Tax Rate. The tax rate ranges from 05 to 25 and is typically paid by the seller.

California State Sales Tax 2018 What You Need To Know Taxjar

Proposition 172 1993 extended the state sales tax rate of 6 percent.

. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Blue Jay 7750 San Bernardino Blue Lake 7750 Humboldt Blythe 7750 Riverside Bodega 8125 Sonoma Bodega Bay 8125 Sonoma Bodfish 7250 Kern Bolinas 8250 Marin Bolsa 7750 Orange. Persons other than lessors of residential real estate ARE REQUIRED to file a Return for tax year 2018 if in 2018 you were engaged in business in San Francisco as defined in Code section 62-12 qualified by Code sections 9523 f and g were not otherwise exempt under Code sections 906 or 954 and you. To review the rules in California visit our state-by-state guide.

San Jose CA Sales Tax. This 725 total sales tax rate hasnt changed for 2018. San Fernando Sales Tax Renewal.

There are many counties and cities with higher rates. San Geronimo CA Sales Tax Rate. San Gabriel CA Sales Tax Rate.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. You can read a breakdown of Californias statewide tax rate here. The statewide California sales tax rate is 725.

Has impacted many state nexus laws and sales tax collection requirements. Details Background Before 2014 San Francisco imposed a 15 percent payroll tax on businesses operating in the city. San Joaquin Hills CA Sales Tax Rate.

San Fernando CA Sales Tax Rate. Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more than 2000000in combined taxable San Francisco gross receipts. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy.

Fast Easy Tax Solutions. That translates to a tax rate increase from 0475 percent to 056 percent on its gross receipts. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division.

Effective April 1 2018 the following City sales tax rates will change. Then there is a 15 percent state tax on marijuana and a 10 percent Oakland tax on. What is the sales tax rate in San Francisco California.

The Basics of California State Sales Tax. No not even in California. Had more than 300000 in taxable San Francisco payroll.

San Gregorio CA Sales Tax Rate. Concord 875 San Mateo County TBA 050 November 2018 ballot San Diego 775 Daly City 875 Denver 765 Redwood City 875 Miami 700 San Francisco 850 Boston 625 Walnut Creek 825 Washington DC 575 SourceNotes CURRENT Bay Area Sales Tax Rates and 2017 Sales Tax Ballot Measures1 ProposedEnacted Changes in Sales Tax Change in Sales Tax Rate. Two of these resulted from recent voter-enacted initiatives notably.

The San Francisco County sales tax rate is 025. Ad Find Out Sales Tax Rates For Free. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan.

The tax is calculated as a percentage of total payroll expense based on the tax rate for the year. This rate is made up of a base rate of 6 plus a mandatory local rate of 125. Tacoma 102 percent and Seattle 101 percent Washington and Birmingham Alabama 10 percent.

Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent. City of South San Francisco Sales Tax Measure W November 2015 San. The 2018 United States Supreme Court decision in South Dakota v.

The County sales tax rate is. This is the total of state county and city sales tax rates. A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California sales tax.

The 2018 Payroll Expense Tax rate is 0380 percent. There is the regular state sales tax of 6 percent and the regular Alameda County sales tax of 325 percent. With the addition of locally approved county and municipal taxes the total combined sales tax rate can be as high as 1025 the highest in the United States.

The minimum combined 2022 sales tax rate for San Francisco California is. You can get a list of sales tax rates for California counties and cites as of Oct 1. Did South Dakota v.

The California sales tax rate is currently. Some cities and local governments in San Francisco County collect additional local sales taxes which can be as high as 3625. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar.

California sales tax rate. This scorecard presents timely information on economy-wide employment indicators real estate and tourism. This rate is made up of 600 state sales tax rate and an additional 125 local rate.

The San Francisco County Sales Tax is 025. San Francisco charges a tax equal to a percentage of a propertys sale price on the transfer sale of commercial and residential property sold within city boundaries. On the proportion of local payroll and.

Beginning January 1 2019 a number of tax law changes will become effective in the City of San Francisco the city. The rate for San Francisco is 85. Three cities follow with combined rates of 10 percent or higher.

San Francisco CA Sales Tax Rate. Exemption provisions are listed in Section 954The most common exemption is for certain non-profit organizations. The Homelessness Gross Receipts Tax which was passed on November 6 2018 ballot is imposed on the gross receipts of a business above 50000000.

850 Is this data incorrect The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. The Payroll Expense Tax will not be phased out in 2018 as originally planned due to less-than-expected revenue from the Gross Receipts Tax. There is no applicable city tax.

San Joaquin CA Sales Tax Rate. The San Francisco sales tax rate is.

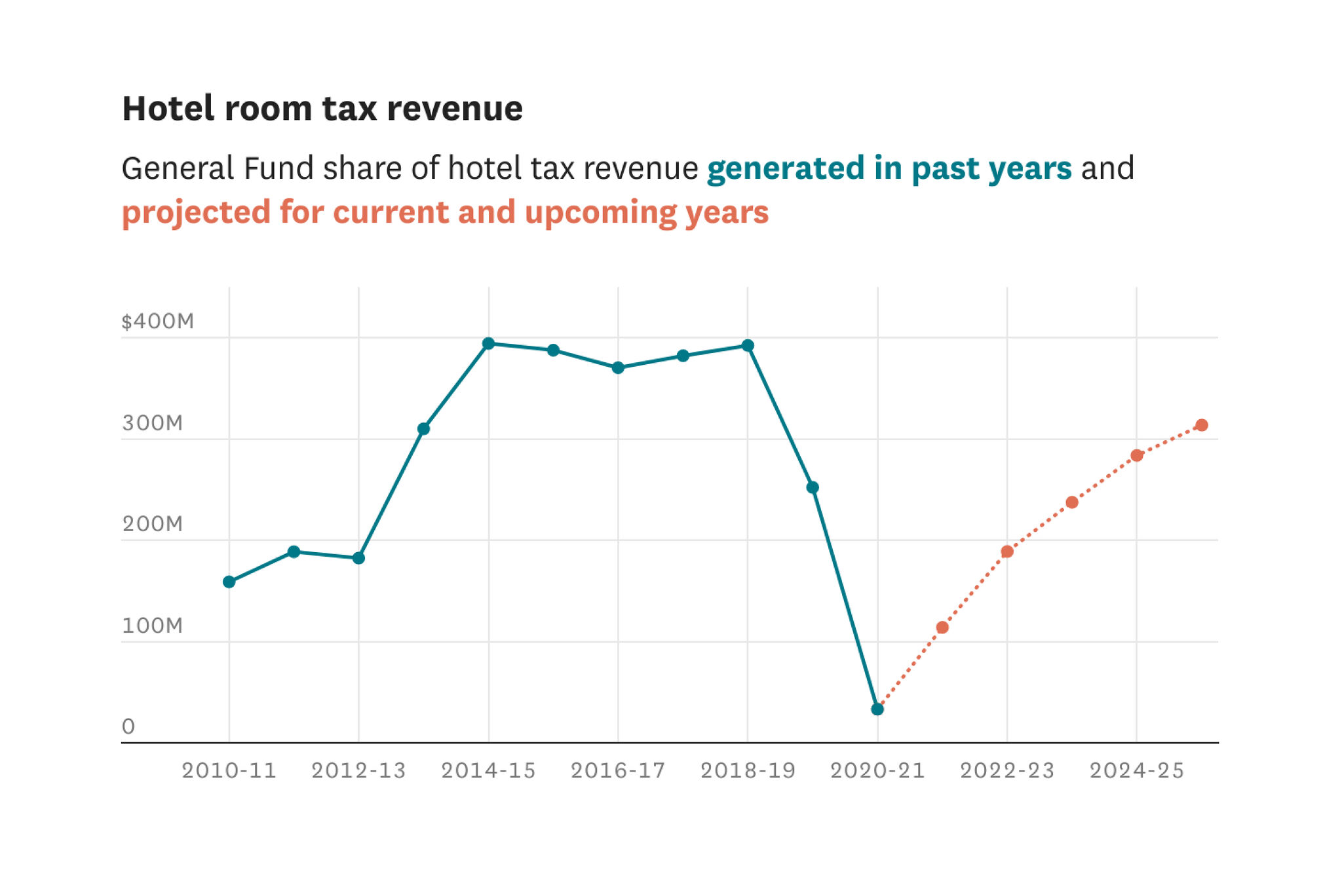

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers

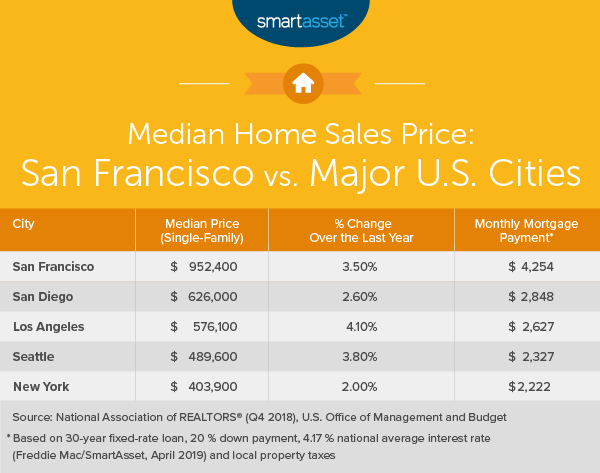

What Is The True Cost Of Living In San Francisco Smartasset

Debtrelieftips Sales Tax Debt Relief Programs Online Sales

California Sales Tax Small Business Guide Truic

San Francisco Prop W Transfer Tax Spur

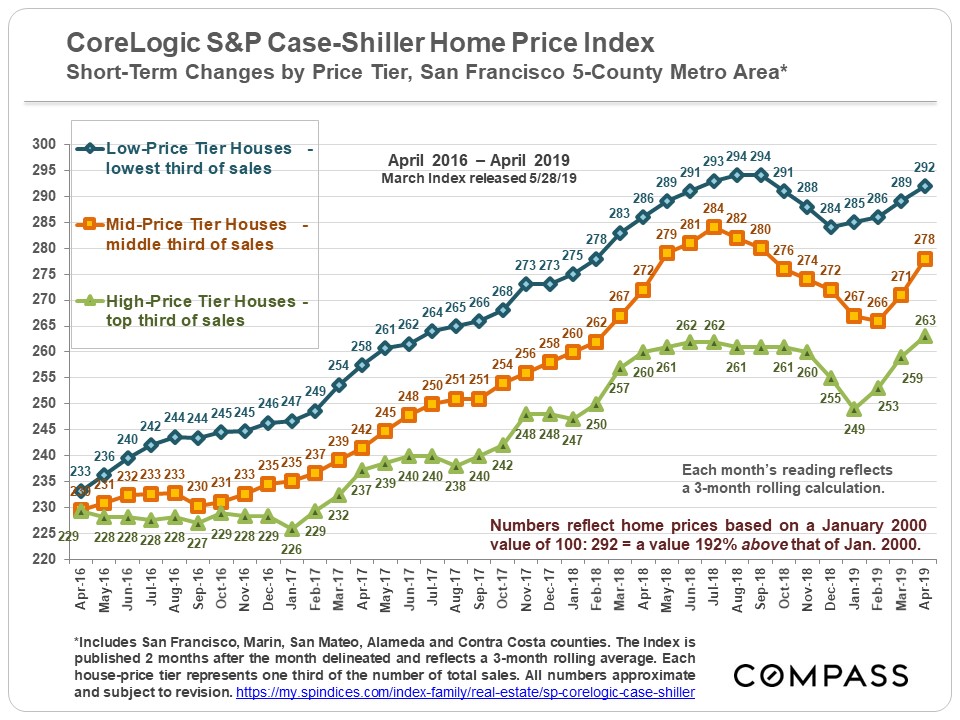

In Housing Market Gone Nuts Condo Prices Sag In San Francisco Bay Area Hover In 3 Year Range In New York Rise At Half Speed In Los Angeles Wolf Street

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

The Downturn Persists Examiner Analysis Reveals That S F S Economy Has A Long Road To Recovery The San Francisco Examiner

At What Income Level Does The Marriage Penalty Tax Kick In

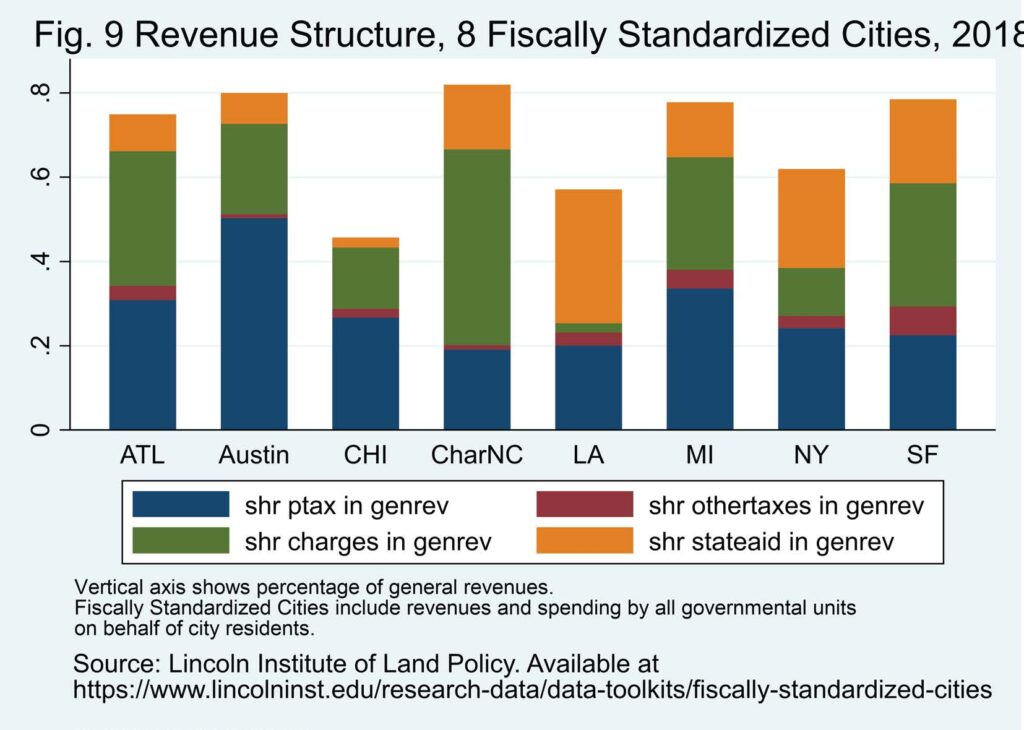

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

How Do State And Local Sales Taxes Work Tax Policy Center

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

San Francisco Tax Update Deloitte Us

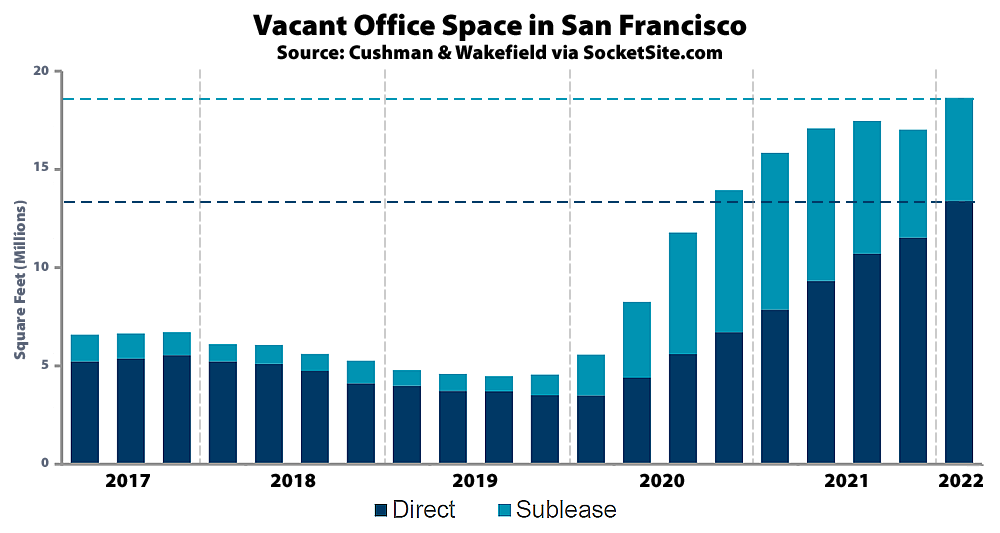

Office Vacancy Rate In San Francisco Hits A Pandemic High

Tax Rates Which County In Your State Has The Highest Tax Burden

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

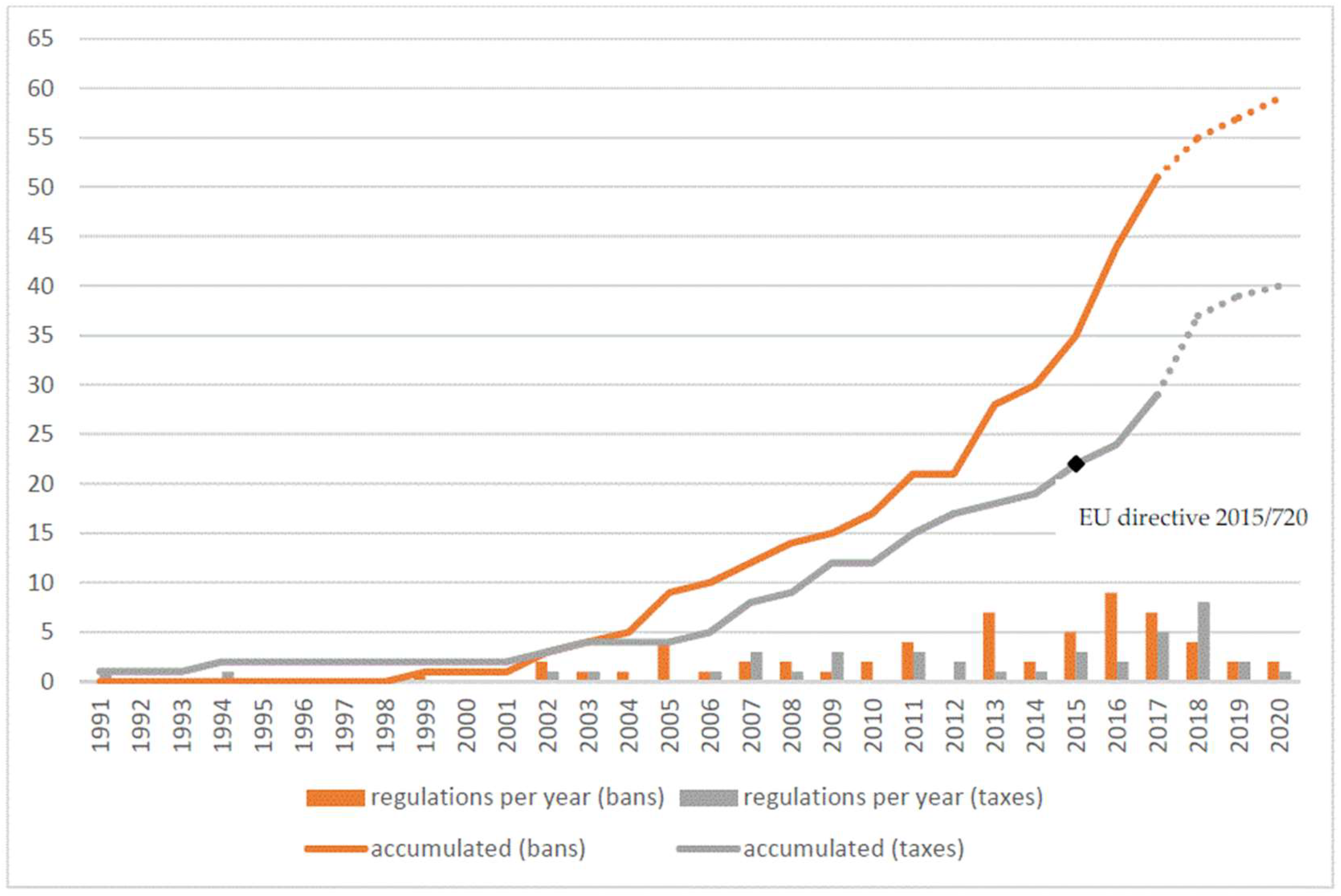

Sustainability Free Full Text Developing Countries In The Lead What Drives The Diffusion Of Plastic Bag Policies Html