san francisco gross receipts tax 2021 due dates

The last four 4 digits of your. The rates generally are increased again for the 2022 2023 2024 tax years and.

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial Rents taxes.

. The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable gross receipts. 2021 Annual Business Tax Returns. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial. The due date for filing the San Francisco 2021 Annual Business Tax SF ABT return which includes reporting and payment of 1 the Gross Receipts Tax GRT or Administrative Office. The filing obligation and tax rates for all.

Your seven 7 digit Business Account Number. The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of. File the CA Franchise Tax due with Form 100 if extended.

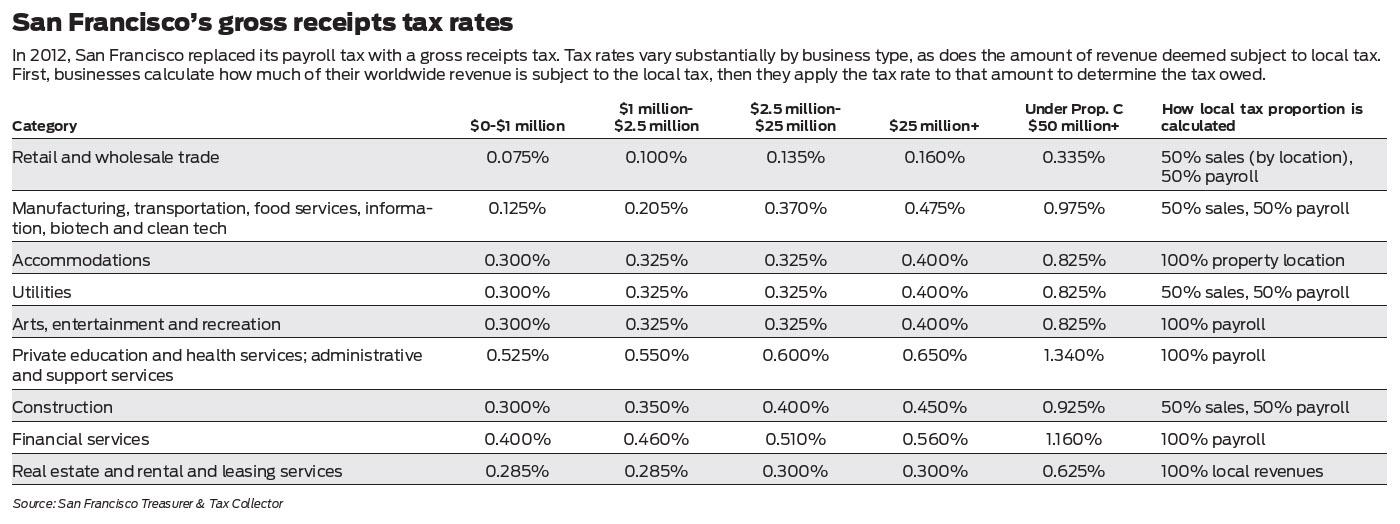

Additionally businesses may be subject to up to three city taxes. The city of San Francisco levies a gross receipts tax on the. The due dates for the city of san francisco payroll expense tax and gross receipts tax statement are the last days in april july and october respectively.

San Francisco voters on November 3 2020 approved two propositions that will increase the citys gross receipts tax. An extension can be filed by February 28 2018 to extend the filing due date to May 1. Q3 Estimated SF Gross Receipts Tax installment payment.

Annual Business Tax Returns 2021 The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness. Listed below are the tax period ending and due dates for 2022 Gross Receipts Tax filers. Delaware Quarterly Estimated Franchise Tax Pay.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last. Lean more on how to submit these installments online to comply with the Citys business and tax regulation. Beginning in 2021 Proposition F named the Business Tax Overhaul raises.

Who is subject to San Francisco gross receipts tax. To begin filing your 2021 Annual Business Tax Returns please enter. Due on april 30 2020 are.

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Annual Business Tax Returns 2021 Treasurer Tax Collector

Sf Voters Approve First In The Nation Ceo Tax That Targets Inequality Calmatters

States Latest Weapon In The Struggle For Tax Revenue Gross Receipts Taxes Accounting Today

2022 San Francisco Tax Deadlines

Annual Business Tax Returns 2020 Treasurer Tax Collector

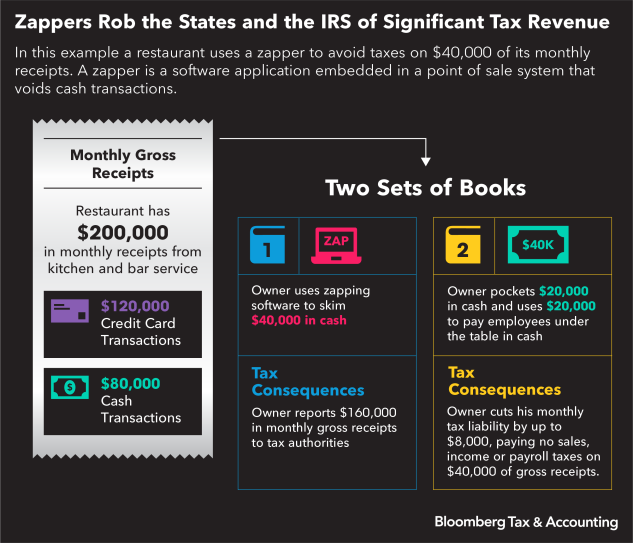

Tax Zappers Found In One Fifth Of California Restaurants

What Is Gross Receipts Tax Overview States With Grt More

Oregon S Gross Receipts Tax Proposal Would Increase Consumer Prices Tax Foundation

Doordash 1099 Taxes And Write Offs Stride Blog

2022 San Francisco Tax Deadlines

Prop C Would Raise Sf S Gross Receipts Tax Here S What That Means

2022 San Francisco Tax Deadlines

Tracking The San Francisco Tech Exodus Sf Citi

S F Businesses Will Find Remote And Hybrid Work Are Going To Be Taxing Matters

San Francisco Taxes Filings Due February 28 2022 Pwc

Jose Cisneros Treasurersf Twitter